capital gains tax services

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Its the gain you make thats taxed not the.

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Short-term capital gains are gains apply to assets or property you held for one year or less.

. Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. Taxes capital gains as income and the rate reaches. The current capital gains tax allowance is.

Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate. It is levied separately from income tax on normal wages. Taxes capital gains as income and the rate reaches 660.

The Office of Tax Simplifications second report on capital gains tax in 2021 recommended that changes be made to address this. The new rules allow. If you sell them for more than you bought them for capital gains tax is a tax on the profit you.

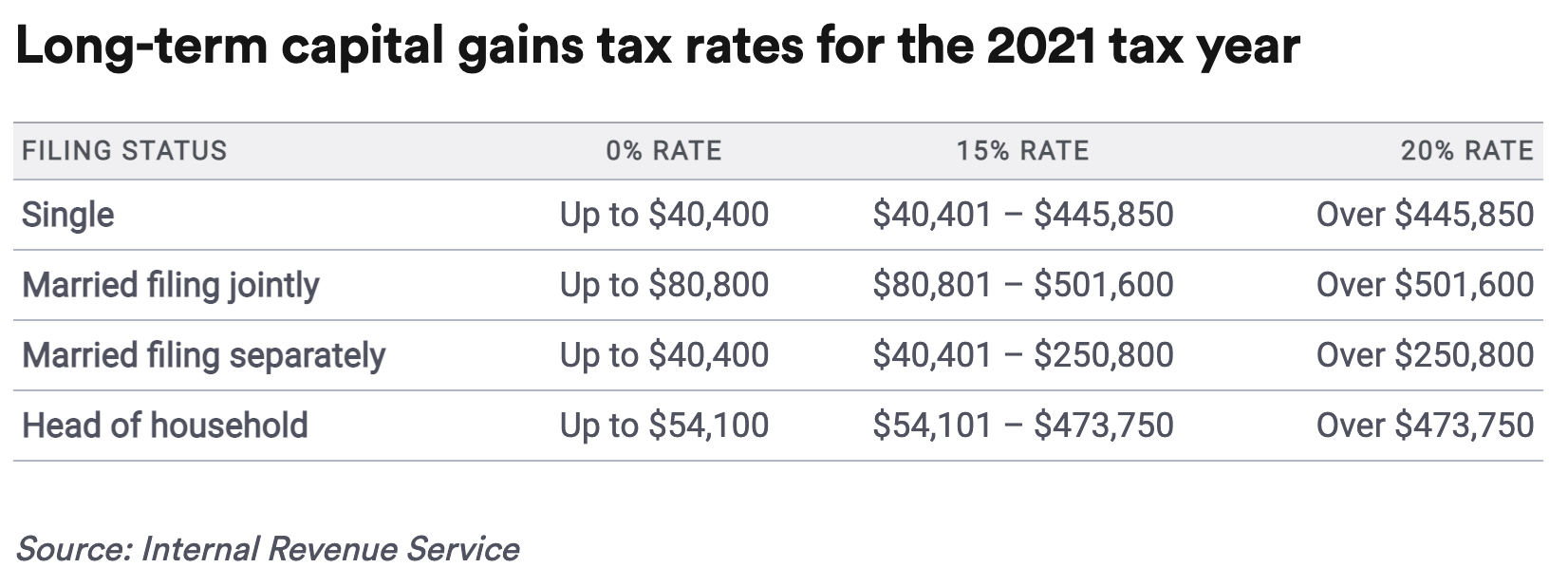

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 20 28 for residential property. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home.

The special rate of CGT and the limit apply for. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. 2022 federal capital gains tax rates.

Capital gains tax is relevant when you sell or gift a property business share incentives and so on. The capital gains tax is a federal tax levied against any profit on the sale of capital assets. For example a single person with a total short-term capital gain of.

Most taxpayers are already. The relevant legislation is contained in the Eighth Schedule. A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed its base cost.

They are subject to ordinary income tax rates meaning theyre. Connecticuts capital gains tax is 699. Fund distributions Information on capital gains dividends and return of capital.

For the 20222023 tax year these tax rates are 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. You can use the service to report gains on assets you sold during the tax year. Report using the real time Capital Gains Tax service.

The capital gains tax allowance is the amount of profit you can make from the sale of an asset before you have to pay capital gains tax. Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds. Just like income tax youll pay a tiered tax rate on your capital gains.

Based on this the total capital. Capital gains tax rates on most assets held for less than a year are taxed. Capital Gains Tax Capital Gains Tax Overview Standard and higher rates of capital gains tax CGT together with the annual exemption.

The portion of any unrecaptured section 1250 gain from selling section. If your income falls in the 44626-492300 range for 2023 your tax rate is 15. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

Short-term capital gain tax rates. The remaining 10000 would then bring the total taxable income over the 50000 threshold meaning they would then be charged at the higher rate of 28. Learn which funds are paying capital gain distributions qualified.

Raising The Capital Gains Tax Who Does It Really Hurt U S Chamber Of Commerce

The States With The Highest Capital Gains Tax Rates The Motley Fool

What You Need To Know About Capital Gains Tax

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Archives Osprey Accounting Services

Green Valley Tax Services Inc Napa Ca Facebook

Tax Services Tucson Arizona Capital Finance Az Llc

What You Should Know About Capital Gains Tax Legalzoom

Edward B Harmon Biden S Tax Plan Would Damage Economy

Voters Overwhelmingly Give Thumbs Down To Capital Gains Tax Association Of Washington Business

Tax Preparation Services Efs Group Pllc

A Capital Gains Tax For Seattle New Progressive Revenue Measure Enters The Conversation The Urbanist

Tax Talk Selling Property Here S What You Should Know About The Capital Gains Tax A A Tax Accounting Services Llc

Using Capital Gains To Pay For College Resilient Asset Management

Biden S Capital Gains Tax Plan Would Upend Estate Planning By The Wealthy Midwest Financial Advisors Group

Ask Your Business Accounting Questions On Twitter If You Sold Stock Or Sold A House Recently That Profit Is Taxable By The Government Here Are A Few Strategies Recommended For Avoiding Or Reducing

A List Of Some Of The Taxes We Pay Federal Income Tax Indirect Tax Tax Services

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep